Charter schools are gaining popularity as an alternative education option for students. However, charter schools, like other schools, may experience budgetary problems and financial difficulties from time to time. That is why it is important for charter schools to have a guide on financial management. Here are some tips for charter school finance guide:

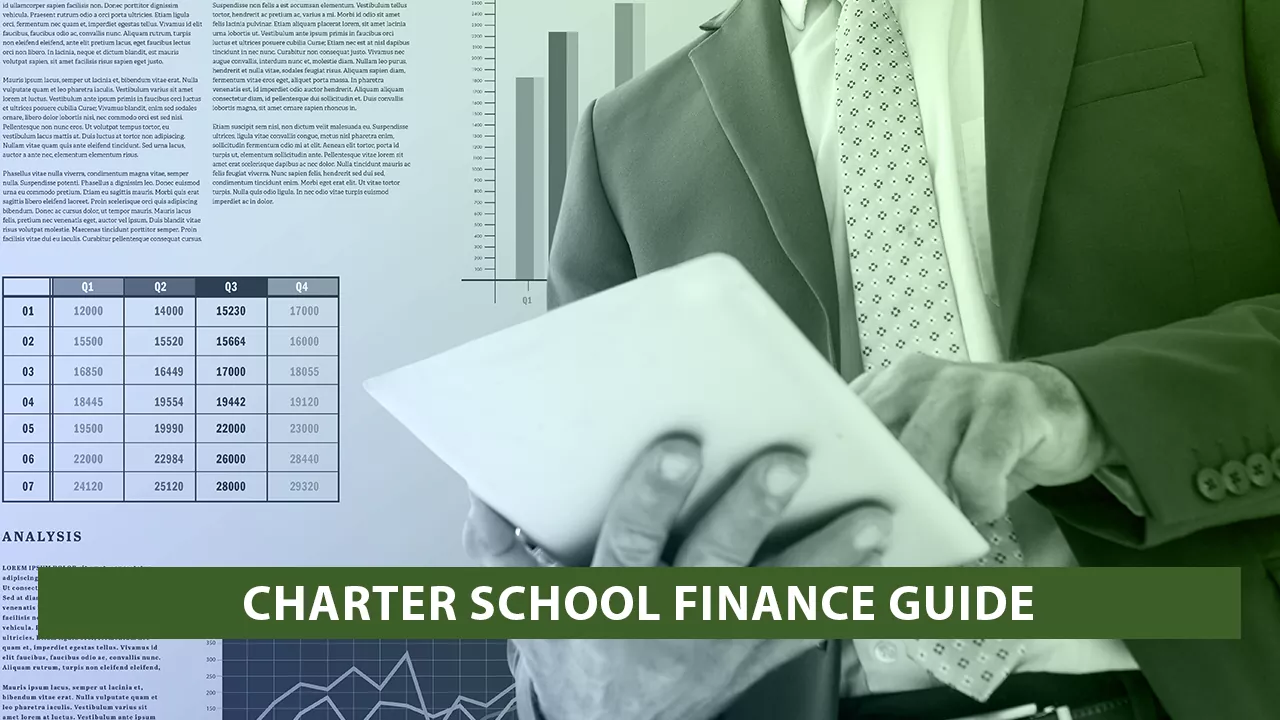

- Budget Planning: Charter schools should focus primarily on budget planning. Schools should regularly review and update their budgets so that they are in control and have enough resources to meet their future needs. In this way, charter school finance will definitely get a progress.

- Sources of Income: Charter schools should diversify their sources of income and seek different sources of funding. For example, it is important to generate income from sources such as grant applications, donations, sponsorships and student enrollment fees.

- Cost Control: Charter schools must use a variety of methods to control their costs. This means increasing efficiency, optimizing operational processes and negotiating with suppliers to reduce costs per student.

- Personnel Management: Personnel management is an important factor influencing the financial situation of charter schools. Schools should regularly review staff salaries and other expenses and make cuts as needed to make room in their budgets.

- Financial Analysis: Charter schools should monitor their budgets and performance by regularly conducting financial analysis. This helps schools achieve their financial goals and make more informed financial decisions.

- Counseling: Charter schools can seek help from organizations that offer financial consulting services. These services provide support for schools’ budget management, performance analysis, income sources, and more.

These tips can assist in the financial management of charter schools and prevent schools from facing financial difficulties for Charter School Finance.

Whom Does the Charter School Finance Guideline Benefit?

A charter school finance guide can be of benefit to many individuals and institutions. Some examples are:

- Charter School Administrators: The charter school finance guide helps schools better manage their finances by providing financial management support to school administrators. This can increase the long-term success of schools and provide more resources for student success.

- Charter School Founders: The charter school finance guide helps school founders better control their school’s finances by providing guidance on financial planning and budget management. This is important to the long-term success of the school and ensures the school’s growth and development.

- Charter School Teachers: The charter school finance guide can assist teachers with better resource planning. This helps schools provide better education to students and gives teachers greater access to course materials and other resources.

- Parents: The charter school finance guide gives parents more information about the school’s finances, showing that the school has a solid financial foundation. This increases parents’ confidence in the school and encourages them to contribute more to the school.

- Investors and Donors: The charter school finance guide can also be beneficial for investors and donors. This helps them better understand the school’s financial situation and invest more in the school. Also, better managing the school’s financial situation can increase the confidence of investors and donors in the school.

Are There Any Disadvantages to the Charter School Finance Guide?

The charter school finance guide has no direct harm. However, misuse or misinterpretation of the guide may adversely affect the financial condition of the school. For this reason, it is important to use a professional approach and correct methods in the preparation and use of the financial guide.

In addition, the financial guide is a tool that measures the financial situation of the school only in numbers and does not provide any information about the educational achievements of the school or other important factors. Therefore, it should be noted that the financial guide does not give a complete picture of the school and is not sufficient by itself to measure the success of the school.

Also: What Is A Charter School Finance? Everything You Need To Know

Finally, the use of the finance guide can affect the school’s decision-making processes. The finance guide plays an important role in determining the school’s financial goals and budgetary planning, but these decisions must be consistent with the school’s educational goals. Therefore, it is important that the finance guide is used in accordance with all the goals of the school.

Is the Charter School Finance Guide Mandatory?

The charter school finance guide is not legally required. However, many charter schools use a finance guide for financial planning and management. This provides school management with a roadmap on how to use financial resources and achieve the school’s financial goals.

In addition, some states may require charter schools to provide financial reporting or to present financial data in a specific format. In this case, the preparation of a financial guide may also become a necessity.

Overall, the charter school finance guide is a useful tool for managing and keeping control of the school’s financial situation, but is not legally required.